The UK’s Zero Emission Vehicle (ZEV) mandate is a regulatory framework aimed at transitioning to electric vehicles (EVs) to reduce emissions from the transport sector. It outlines specific targets for car manufacturers regarding the proportion of new zero-emission cars and vans they must sell each year. It had mandated that all new petrol and diesel sales would end by 2030, but in September, the UK Government announced, it would be extended to 2035.

ZEV Mandate Extended

In January the revised mandate came into law under the Vehicle Emissions Trading Scheme order, which mandated that 80% of new cars and 70% of new vans will be emission-free by 2030. For 2024, all new car sales from each qualifying brand must be zero-emission, with the target gradually increasing yearly until it hits 100% in 2035. Manufacturers will be liable for penalties of £15,000 for each non-compliant car. OEMs who don’t meet the target percentage can mitigate the fines by buying credits from other OEMS with a surplus.

What does this mean for Car Dealers?

1. Increased Depreciation of Older Vehicles

If OEMs reduce prices on new EVs to meet ZEV targets and avoid fines, the immediate effect could be an accelerated depreciation of older vehicles, both ICE (Internal Combustion Engine) vehicles and earlier models of EVs. As the price gap between new and used cars narrows, consumers may opt for new vehicles, reducing the demand and the resale value of used cars.

2. Market Distortion due to the ZEV Mandate

Aggressive pricing strategies for new EVs could distort the market by artificially lowering the cost of entry for new EVs. This could lead to an imbalance between supply and demand in the used car market. Resulting in a faster turnover of vehicles, with consumers choosing to buy new rather than used.

3. Impact on Consumer Perception

Discounting new EVs to avoid fines could impact consumer perception, with buyers waiting for discounts before purchasing, leading to a slow-down in the adoption rate. This wait-and-see approach could temporarily decrease the demand for new and used vehicles.

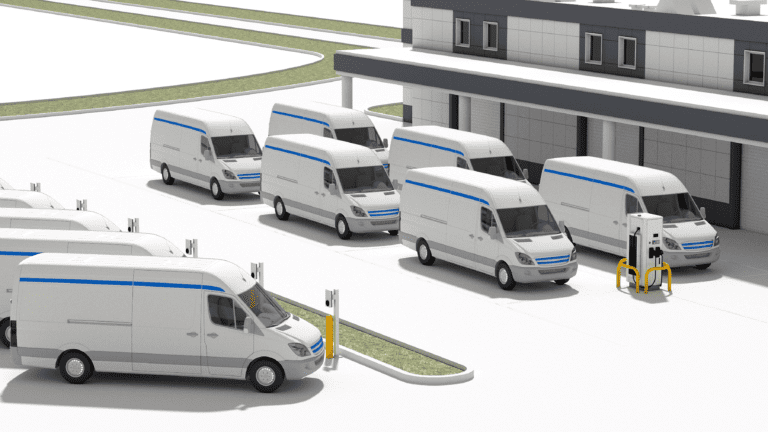

4. Strategic Fleet and Lease Management:

OEMs and dealerships might strategically manage fleets and leasing options to adjust the supply of vehicles and influence the market. By increasing the availability of leased vehicles or offering buy-back programs, manufacturers can control the number of used vehicles entering the market, potentially mitigating the impact on depreciation.

5. Enhanced Appeal of EVs and Impact on ICE Vehicles:

The enhanced appeal of discounted new EVs could further diminish the demand for ICE vehicles, accelerating their depreciation and potentially leading to a quicker phase-out of such vehicles from the market.

What’s the recent experience in the UK car market?

All of the factors above have been experienced, somewhat, by the industry in the past 12 months. Consumers’ appetite for used EVs was already tested by concerns over battery health, charging infrastructure and fears of technological obsolescence. Chuck in the Tesla led price wars and many described 2023 as a “bloodbath” for EVs.

With resale values falling by 20%+ used dealers are becoming wary of stocking EVs, with just 20% offering them for sale. And with a dwindling supply of petrol and diesel vehicles demand for these models is increasing rather than softening. This has prompted many to expect the ZEV mandate to be pushed back beyond 2035. In a poll at Car Dealer Live this month, 63% of respondents felt it would be extended.

Is this just a combination of confirmation and recency bias? The data seems to suggest it is.

What does the data tell us?

According to Cox Automotives Fuel-Type forecast 2024-2027, the writing is on the wall for the supply of diesel and petrol cars in the UK Car Parc. It estimates the share of ICE vehicle registrations drops to just 38% by 2027, with Diesel at 3% almost eliminated.

The report’s author and Cox Automotive Insights Director, Philip Northard, noted:

“It’s almost impossible to overstate the shift in the UK car parc over the past four years and how that change will continue to accelerate over the next four years and beyond. Today’s market for cars aged 0-4 years differs significantly from 2020 and will contrast even more so in 2028. Manufacturers will continue to be driven by legislation rather than consumer demand and ICE will be all but gone from the UK new car market long before the 2035 deadline. For dealers, this means a battle for the best stock, for consumers it means diminishing choice and above-inflation price increases.”

So it appears the decline in inventory for ICE vehicles will support prices unless consumers eschew them for EVs. This isn’t unlikely as 4 years is a long time to develop charging infrastructure, for new technologies to emerge and to overcome concerns about the longevity of EV batteries.

If the forecast is correct, it contrasts with the opinion of dealers and the small proportion stocking used EVs. If dealers don’t get on board now, they may find themselves left behind when the transition gathers pace post-2027. It’s only around the corner.

What can dealers do to prepare?

- Start stocking used EVs, educate yourself and your staff

- How can you help your customers with the transition, there may be limited demand for EVs right now, but will they stomach higher prices for ICE vehicles?

- Partner with emerging companies offering products which smooth the transition for consumers such as EV bundles, Extended Warranties or Battery Analytics

- If you feel BEV is too big a step right now, start with PHEV or mild hybrids to build confidence