As more electric vehicles enter the market through car leasing and fleets, one aspect of the electric revolution that will grow is the used EV market. One factor influencing the market for used EVs is their residual value, which determines whether leasing companies sell their vehicles at a profit or loss. What should you know about the residual value risk of EVs as a car leasing company operator or fleet owner? This article answers the question and more.

The EV leasing scene at a glance

Car leasing companies have traditionally rented out internal combustion engine cars. However, with the emergence of battery-powered vehicles, these companies are starting to offer EVs to satisfy their customers. Rental is a popular method for people to get into EVs, and the electric car rental market is projected to cross USD$19 billion by 2027.

Hertz set the stage when it ordered 100,000 EVs from Tesla. Its competitors have since duplicated the move, meaning there will be plenty of used EVs to dispose of in the electric car leasing market a few years from now.

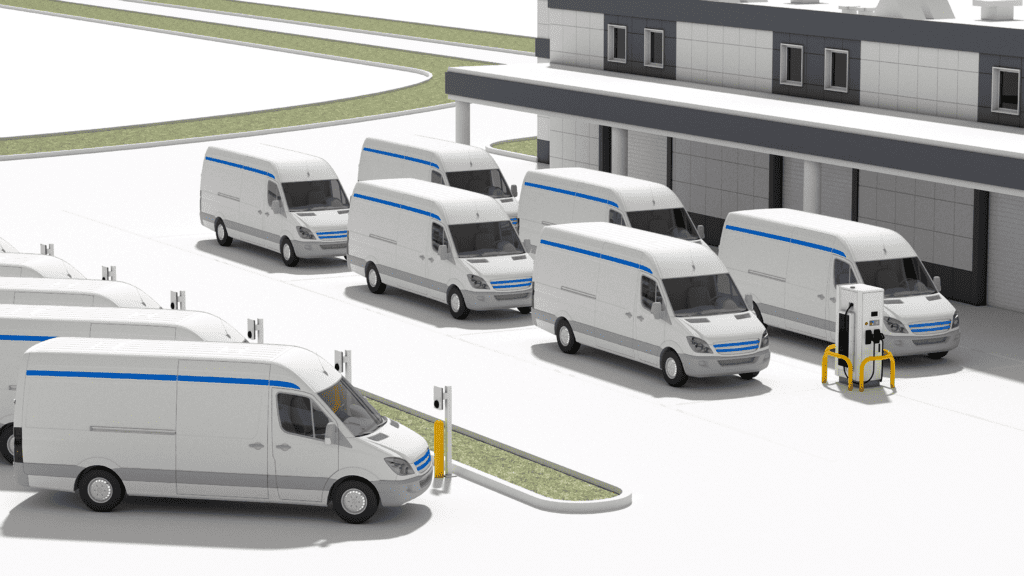

The EV fleet scene at a glance

Similarly to car leasing, the vehicle fleet sector used to be based on the internal combustion engine. Electric vehicles are also beginning to show up, based on clients’ demands. Fleet Alliance, for example, reported a 214% increase in EV orders in 2021.

The share of EVs in the global fleet business will only rise as companies like Tesla, Volvo, and Kenworth look set to start delivering battery-powered trucks.

Residual values of electric cars

Like the ICEs before them, EVs do depreciate. Car leasing companies and fleet operators have had decades to master how to quantify the residual value of ICEs when disposing of them. However, with EVs, these companies have to relearn. For example, car leasing companies typically sell their vehicles after three years, but does that apply to EVs, which tend to last longer? In addition, ICEs are usually sent to car auctions after they are returned; will disposing of EVs this way ensure the highest possible internal rate of return (IRR)?

EV residual value uncertainty

While EVs tend to last longer, it does not translate to higher residual values. Several factors are at play here, including the inability of second users to gain from tax incentives. In addition, the EV industry is still in its infancy, meaning there is rapid innovation and lower demand for older EVs.

Another factor contributing to the uncertainty of EV residual value is tied to the battery. When a used EV is due to be passed to another user, the battery may need a replacement, which may lead to a drop in value for the car.

A seemingly simple solution to the battery problem would be car lease companies and fleet operators testing them to ascertain their health. The result would then be factored into the residual value of the used car. However, testing EV batteries is an expensive process. Fleet operators often purchase multiple models from multiple OEMs with different battery architectures, complicating any potential testing procedure.1

The lack of data on the battery’s health results in a higher depreciation rate for EVs. However, the depreciation rate is not uniform across manufacturers and models.

What does this mean for the car lease or fleet operator?

The US leased vehicle market is estimated at a $200 billion residual value. A 10 percent drop in residual value represents $20 billion in lost revenue, highlighting why car lease or fleet operators must pay attention to this aspect of the business.

According to Matt Dale, ALD Automotive’s head of consultancy, one way that car lease and fleet managers can reduce the total cost of ownership is to take advantage of EVs’ tendency to last longer. He proposes leasing the vehicle to second and third clients. This means the company keeps the EV longer and reduces the residual value risk as it is only at the point of disposal that either profit or loss is realized.

Conclusion

The car leasing and fleet management business is bound to change as the industry finds a way to deal with residual value risk on used EVs.

Notes and sources:

1Brown P., Coltelli M., Esamann D., Malik J., Mortier T., Watson S. “How commercial fleet electrification is driving opportunities” EYGM (2020): 8.